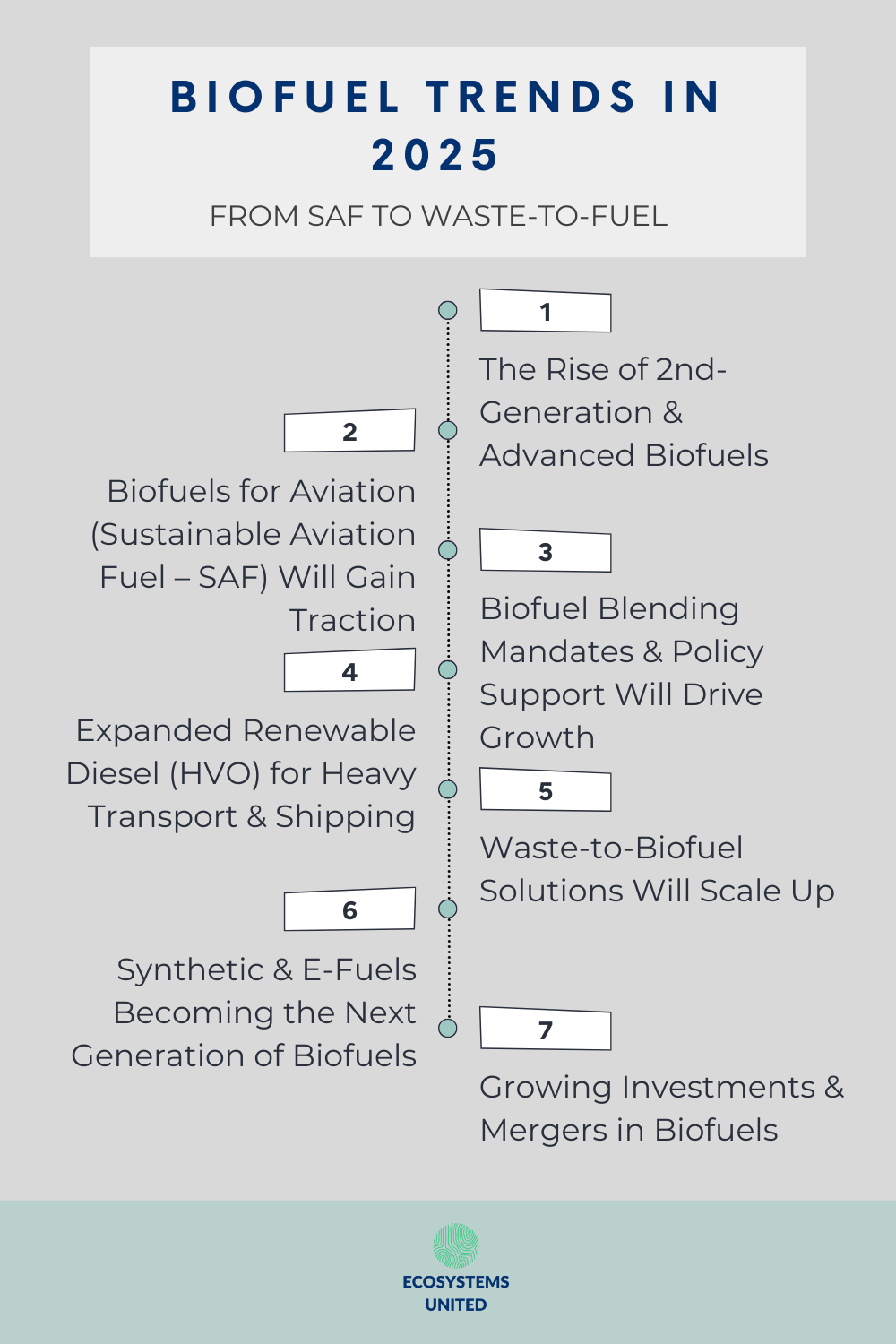

7 biofuel trends to expect in 2025

As the world moves toward decarbonization, biofuels will play a crucial role in the transition to cleaner, renewable energy sources. In 2025, several key trends will shape the biofuel industry, from advanced feedstocks to policy-driven market growth. Whether you are looking to invest in biofuels or just want to stay informed on industry developments, here are 7 of the top biofuel trends to keep an eye on this year.

Trend 1: The Rise of 2nd-Generation & Advanced Biofuels

Traditional biofuels like corn ethanol and soybean biodiesel face growing concerns over land use and food security. In 2025, expect a shift toward non-food-based biofuels, including:

- Cellulosic ethanol (from agricultural waste, forestry residues, and municipal waste)

- Algae-based biofuels (producing high yields without competing for farmland)

- Biofuels from industrial waste gases (such as LanzaTech’s carbon recycling technology)

These second-generation biofuels reduce competition with food crops while lowering greenhouse gas (GHG) emissions more effectively.

Trend 2: Biofuels for Aviation (Sustainable Aviation Fuel – SAF) Gaining Traction

With aviation accounting for 2-3% of global CO₂ emissions, sustainable aviation fuel (SAF) is a major focus for reducing airline carbon footprints.

- Major airlines (United, Delta, Lufthansa) and fuel producers (Neste, BP, TotalEnergies) are ramping up SAF production.

- Feedstocks include used cooking oil, forestry residues, algae, and synthetic e-fuels.

- Government incentives and mandates (e.g., EU ReFuelEU Aviation initiative and U.S. SAF tax credits) will accelerate adoption.

By 2025, SAF production is expected to scale up, with increasing commercial flights running on bio-based jet fuel blends.

Trend 3: Biofuel Blending Mandates & Policy Support Driving Growth

Governments worldwide are expanding biofuel mandates to reduce fossil fuel reliance and cut emissions:

- U.S.: The Renewable Fuel Standard (RFS) continues to push for higher ethanol and biodiesel use.

- EU: The Fit for 55 package aims for higher biofuel incorporation in transport fuels.

- India & Brazil: Higher ethanol blending mandates (E20 in India, E27 in Brazil) are expanding domestic biofuel markets.

Expect more aggressive blending policies as countries seek energy security and decarbonization.

Trend 4: Expansion of Renewable Diesel (HVO) for Heavy Transport & Shipping

Unlike traditional biodiesel, renewable diesel (hydrotreated vegetable oil – HVO) is chemically identical to petroleum diesel, making it compatible with existing diesel engines and infrastructure.

- Heavy transport (trucks, buses, construction vehicles) is adopting HVO as a drop-in fuel.

- Shipping companies are increasingly using biofuels to comply with IMO (International Maritime Organization) carbon regulations.

- Producers like Neste, Valero, and TotalEnergies are expanding HVO production.

By the end of 2025, renewable diesel could outpace biodiesel as a preferred alternative in the trucking and maritime industries.

Trend 5: Waste-to-Biofuel Solutions Scaling Up

As concerns over land use and sustainability rise, more companies are investing in waste-to-fuel technologies:

- Municipal solid waste (MSW) → biofuels (e.g., Enerkem’s waste-to-ethanol projects)

- Used cooking oil & animal fats → biodiesel & SAF

- Agricultural residues (corn stover, wheat straw) → cellulosic ethanol

This circular economy approach reduces waste and provides low-carbon fuels with minimal land footprint.

Trend 6: Synthetic & E-Fuels: The Next Generation of Biofuels?

New biofuel innovations are merging with electrification and hydrogen technologies to create synthetic fuels (e-fuels):

- Power-to-X (PtX) fuels combine renewable electricity, hydrogen, and CO₂ to create liquid fuels.

- Porsche and Siemens are investing in e-gasoline and e-diesel as low-emission alternatives for cars and aviation.

- While still expensive, advancements in green hydrogen and CO₂ capture could make synthetic biofuels a viable option in hard-to-decarbonize sectors.

Trend 7: Investments & Mergers in the Biofuel Sector

With rising demand for clean energy, major oil & gas companies and renewable startups are merging and forming partnerships to expand biofuel production:

- BP & Neste collaborating on SAF production

- Shell & Raízen investing in second-generation ethanol in Brazil

- Chevron acquiring Renewable Energy Group (REG) for biodiesel expansion

Expect more corporate investments in advanced biofuels, as traditional energy companies shift toward renewables.

A Recap of 7 Biofuel Trends to Expect in 2025

- Cellulosic ethanol & waste-based biofuels will gain momentum.

- Sustainable Aviation Fuel (SAF) will see larger-scale commercial adoption.

- Renewable diesel (HVO) & shipping biofuels will become key players in heavy transport.

- Oil majors & biofuel startups will form new partnerships to expand biofuel capacity.

- Waste-to-biofuel solutions will become more commercially viable.

- High tech alternatives will emerge as a fourth generation of biofuels.

- Corporate mergers and investment in biofuels will drive biofuels into mainstream conversations.

The Bottom Line: Biofuel trends in 2025 point to a breakout year for the industry, with technological advancements, policy support, and growing market demand driving sustainable fuels closer to the mainstream.

💡 Enjoyed this post? Stay connected!

Join our growing network of sustainability-minded individuals at Ecosystems United.

🔗 Share this post with someone who might find it useful.

💬 Leave a comment below and share your thoughts – what do you think will be the biggest biofuel trend in 2025?

📩 Subscribe to get fresh content straight to your inbox!

Discover more from Ecosystems United

Subscribe to get the latest posts sent to your email.

2 Comments