biofuels in the aviation industry: 5 trends transforming sustainable flight

Biofuels in the aviation industry, especially Sustainable Aviation Fuel (SAF), are gaining momentum as low-emissions alternatives to fossil jet fuel. This article explores how airlines, governments, and innovators are accelerating the shift to cleaner skies.

Why Biofuels Matter in Aviation

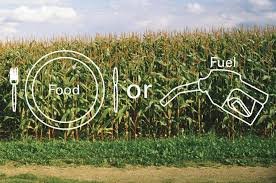

Aviation currently accounts for about 2% of global CO₂ emissions, and airlines face growing pressure to reduce their carbon footprint. Biofuels — particularly Sustainable Aviation Fuel (SAF) made from renewable sources — can cut lifecycle greenhouse gas emissions by up to 80% compared to conventional kerosene jet fuel (AFDC, 2024). This emissions reduction is a key driver behind SAF adoption.

The international aviation sector has set an aspirational goal to reach net-zero carbon by 2050, with SAF widely viewed as the best near-term solution. Airlines also see biofuels as a hedge against oil price volatility and supply disruptions. As Delta’s Chief Sustainability Officer, Amelia DeLuca, put it: “SAF is the best-known lever we have to decarbonize aviation… we need as much SAF as we can get” (CARB, 2024).

In addition, SAF enhances brand reputation — helping airlines attract environmentally conscious travelers while signaling climate leadership to investors and regulators alike.

As SAF moves from early adoption to global momentum, several key trends are emerging across the aviation industry. From airline strategies and policy mandates to technological breakthroughs, these developments are shaping the future of biofuels in the aviation industry. The following five trends reveal how the sector is moving from ambition to implementation.

1. Airline commitments to biofuels in the aviation industry

Airlines across the globe have announced bold commitments to incorporate biofuels in their operations. Many see SAF as crucial for meeting industry climate targets (like the IATA pledge for net zero by 2050) and government mandates.

For example:

- Delta & Southwest: Have publicly committed to replacing 10% of their jet fuel with SAF by 2030.

- Oneworld Alliance (including American Airlines, British Airways, and Qantas): Collective 10% SAF target by 2030.

- United Airlines: Leads the U.S. market with multiple SAF investments and off-take agreements, including a $200 million fund dedicated to SAF innovation.

- KLM & Lufthansa: Pioneers in SAF adoption, with regular SAF use on select routes and long-term supply agreements.

These biofuel commitments aren’t just PR—many airlines are signing multi-year purchase deals with SAF producers (e.g., Delta with Gevo, Singapore Airlines with Neste). As of 2023, over 360,000 commercial flights have flown using SAF blends. That number is expected to grow exponentially as production ramps up.

Early adoption of biofuels also boosts an airline’s brand image among eco-conscious travelers, demonstrating leadership and innovation in climate strategy.

See Top 5 Advanced Biofuel Companies for key players behind these shifts.

2. The cost & scalability challenges of biofuels in the aviation industry

Despite growing momentum, cost and supply remain major hurdles to widespread SAF adoption. Currently, SAF is significantly more expensive than conventional Jet A fuel. According to industry reports, U.S. jet fuel averages around $2.85 per gallon, while SAF can range from $4.00 to $7.00 per gallon or more—often 2–5 times the price.

This price premium, or “green premium,” reflects high production costs, limited refining capacity, and expensive feedstocks. While SAF can deliver substantial emissions reductions, the economics still make large-scale adoption challenging for airlines operating on thin margins.

In 2022, SAF accounted for only about 0.1% of total jet fuel used in the U.S. The Biden administration’s SAF Grand Challenge aims to scale annual production to 3 billion gallons by 2030, a dramatic increase from roughly 16 million gallons produced in 2021. But even with aggressive investment, projections suggest the U.S. might reach only ~2.1 billion gallons without further policy and capital support.

“A lot of additional investment is needed to hit that target” – Gordon McManus

Meanwhile, producers are working to improve conversion efficiency, build larger refineries, and explore cheaper feedstocks such as municipal waste and used cooking oil. Many SAF pathways are also beginning to benefit from learning-curve effects, with the expectation that costs will decline as technology scales.

3. Government policies supporting biofuels in the aviation industry

Government support is one of the most important accelerators for sustainable aviation fuel. SAF is still in its early days, and clear policies can make the difference between pilot programs and industry-wide transformation.

In the United States, the Inflation Reduction Act (2022) introduced a blender’s tax credit for SAF of up to $1.75 per gallon, depending on lifecycle carbon intensity. This helps narrow the price gap with fossil jet fuel. Additional federal incentives, grants, and Department of Energy (DOE) funding have supported new SAF projects and refineries.

California provides further support through its Low Carbon Fuel Standard (LCFS), which offers SAF producers credits that can be sold to emitters, creating a direct financial reward for low-carbon fuel use at airports like LAX and SFO.

The European Union has taken a more regulatory approach. The ReFuelEU Aviation initiative mandates a minimum of 2% SAF blending by 2025, increasing to 6% by 2030 and reaching 70% by 2050. The regulation also requires e-fuels (made from green hydrogen and CO₂) to account for at least 2% by 2030, signaling a strong push toward synthetic fuels.

Other countries are also stepping up. Singapore has announced plans for SAF blending mandates by 2026, Japan has a 10% SAF goal by 2030, and Australia is funding domestic SAF production. Globally, the CORSIA scheme from the International Civil Aviation Organization (ICAO) sets emission caps and encourages airlines to adopt offsets or cleaner fuels.

As more governments implement mandates and incentives, they create stable demand signals that encourage investment and innovation across the SAF supply chain.

See The Pros and Cons of Advanced Biofuels for more context.

4. Can biofuels in the aviation industry replace kerosene?

Many stakeholders are asking the big question: Can SAF and other aviation biofuels fully replace fossil jet fuel?

While the answer is “not entirely”—at least not soon—there’s strong evidence that SAF can replace a substantial portion of aviation fuel over the next two to three decades. According to IATA, SAF could deliver up to 65% of the CO₂ reductions needed for the sector to hit net zero by 2050.

However, aviation demand is projected to grow significantly in that timeframe. This means that SAF will need to expand at an extraordinary pace to maintain or reduce emissions.

Short-haul flights may gradually transition to electric or hydrogen propulsion, but medium and long-haul flights, representing the majority of emissions, are expected to rely heavily on SAF.

Synthetic fuels, or e-fuels, made from renewable electricity, hydrogen, and captured CO₂, are another piece of the puzzle. These can be blended with SAF or used as standalone fuels. The EU’s e-fuel mandate is already pushing this segment forward.

Blending levels are expected to increase: from today’s 1–2% SAF on most commercial routes, to 10–20% by the early 2030s, and 50% or more in the 2040s. Some pioneering flights have already flown on 100% SAF in test conditions, proving that the technology works even if it’s not yet widespread.

The consensus is that SAF will be the primary solution for decarbonizing long-distance air travel, but it must be paired with continued R&D, infrastructure investment, and supportive policy.

5. Innovation on the horizon for biofuels in the aviation industry

Although SAF is already viable today, the next generation of technologies and feedstocks will be essential for making it cost-effective, scalable, and truly sustainable. Here’s what’s coming:

- Algae-Based Fuels: Algae can produce far more oil per acre than traditional crops, grow in brackish or saltwater, and don’t compete with food production. Companies are racing to commercialize algae as a low-impact SAF feedstock.

- Municipal Waste & Captured Carbon: SAF is now being developed from household garbage and even direct air capture (DAC) CO₂ streams. These ultra-low-carbon pathways turn trash and emissions into flight-worthy fuel.

- Power-to-Liquid (PtL) Fuels: These synthetic fuels combine green hydrogen with captured CO₂ to create e-kerosene. Already in European pilot production, PtL fuels are expected to scale significantly in the 2030s.

- Advanced Catalysts & Refining Tech: R&D is reducing energy input and increasing conversion efficiency, making fuel production faster, cheaper, and less resource-intensive.

- New Feedstock Certification: The industry is working on certifying novel feedstocks like halophytic plants (which grow in saltwater) and volatile fatty acids from fermentation. More approved pathways = more flexibility and innovation.

In parallel, engine manufacturers like Rolls-Royce and GE are testing engines that can run on 100% SAF. Some OEMs are even considering aircraft optimized specifically for SAF use in the future.

Q&A on biofuels in the aviation industry

Q: What is SAF in simple terms?

A: A low-carbon jet fuel made from waste or renewable materials. It works just like regular jet fuel but with far fewer emissions.

Q: Can planes really fly on biofuels safely?

A: Yes. Thousands of flights have already used SAF blends. SAF is chemically similar to jet fuel and meets all safety standards.

Q: Why is SAF more expensive?

A: It’s a newer technology with limited scale. As SAF production grows and technology improves, costs will decline—much like solar and wind did.

Q: Will SAF replace kerosene completely?

A: Likely not 100%, but it could replace most of it by 2050, especially for longer flights. It’s the cornerstone of aviation decarbonization.

As innovation continues, the barriers to SAF adoption—cost, feedstock availability, and conversion efficiency—will likely shrink. That means biofuels will play an even more significant role in the future of aviation’s clean energy.

The aviation industry’s journey toward net zero is just beginning—and SAF will be one of the jet engines powering that shift.

Enjoyed learning about biofuels in the aviation industry?

Subscribe to the Ecosystems United newsletter for more insights on sustainable energy, ESG trends, and innovation.

Let’s decarbonize our skies.

References:

- U.S. Department of Energy. (2024). Alternative Fuels Data Center

- California Air Resources Board. (2024). Sustainable Aviation Fuel

- Reuters. (2024). Airlines, SAF, and climate policy

- IATA. (2024). Net Zero Roadmap